Rent or buy: does the British obsession with home ownership pay off?

Abdulkader Mostafa, Heriot-Watt University and Colin Jones, Heriot-Watt University

Unlike the Germans, who are a nation of renters, the desire to be a homeowner is firmly rooted in the British psyche. In 2003, the proportion of UK households owning their own home reached a peak of almost 71%. While it has fallen back a little since, 85% of private tennants say they want to be homeowners within a decade. And while 59% of “Generation Rent” think they will never be able to afford a home, the falling owner-occupation rate has not dimmed aspirations.

This can be seen as a reflection of the benefits of home ownership, both financial and non-financial. The financial benefits are generally accepted as very important, but has that always been true? Our study investigated the historical financial gains from buying versus renting from the mid-1970s to the early 2010s.

This study calculates the pure financial return of home ownership at the end of 2012 for households who were first-time buyers (FTBs) in the UK from 1975 to 2011. The study used historical regional and market data such as rents, FTB house prices, mortgage interest rates and loan-to-value ratios.

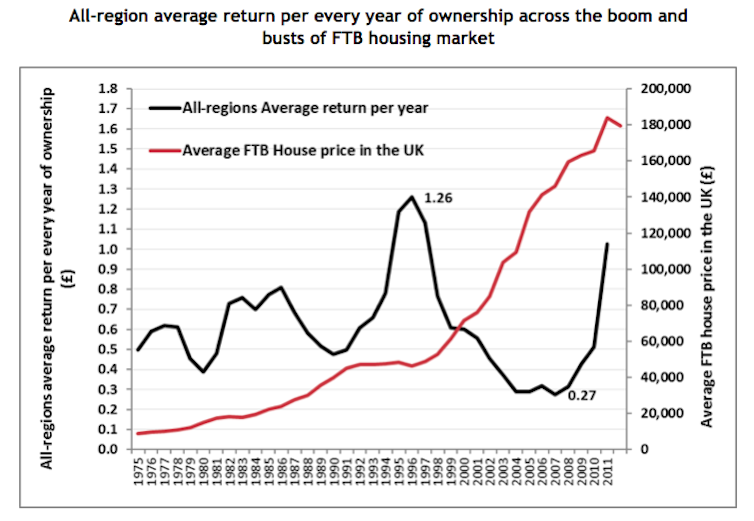

Over the 37-year period there were three defining housing cycles, so we were able to assess the significance of the timing of the house purchase. As would be expected, the returns for FTBs who purchased during a housing market boom were much lower than the returns for those who purchased after a bust.

A numbers game

We looked at the the annual cash difference between the costs of buying and costs of renting across 11 UK regions (but not Northern Ireland). The return was calculated by finding the net present value of the differences between the two over the period a house had been owned.

This technique calculates the incremental return above that which renters would have achieved if they’d invested their capital in a savings account rather than buying a house. In this way we could calculate how much net wealth had been created or lost from buying rather than renting. This calculation was undertaken for an average FTB purchasing every year between 1975 and 2011, assuming the property was sold in 2012.

The findings were powerfully consistent with positive results and very much favoured home purchase with a mortgage over renting. The average FTB created £12.4 of wealth for every £1 of initial outlay over the 37-year period of the study. In other words, an initial outlay of, say, £20,000 invested by a FTB in a house in 1975 was worth £248,000 in 2012.

The scale of return varied with the timing of purchase and how long the house was owned. The highest regional generated wealth remained at £13 (or slightly higher) in five regions including the north-west, Yorkshire & The Humber, London, north-east and Wales, followed by Scotland at £12.4. The lowest return was found in the south-west at £9.8.

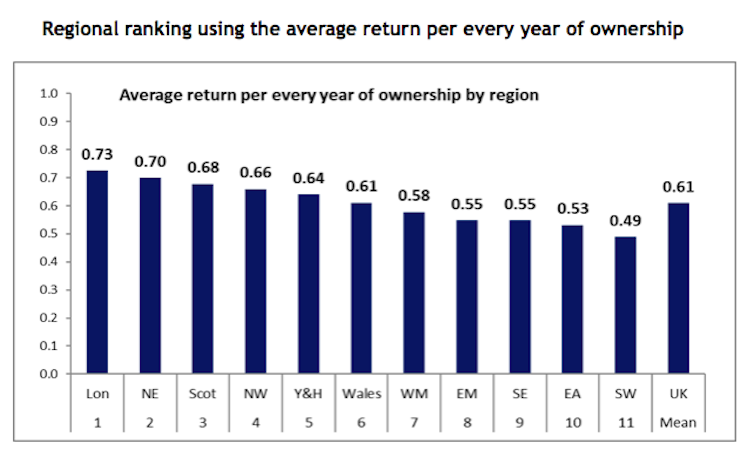

Given that the ownership period of FTBs in this study varied depending on the year of purchase which influenced the gross return, we standardised the return by calculating what was generated for every year of ownership. We found that the average FTB generated £0.61 per every year of ownership for every £1 of initial outlay – so, for example, after 10 years this would equate to £6.10 per initial £1.

Though this needs to be further analysed by researchers, it implied that FTBs on average needed just two years to break even. The regional return ranking shows London at the top and the south-west at the bottom.

The results indicate that timing did matter. The returns for FTBs who purchased during a housing market boom were much lower than the returns for those who purchased after a bust.

Even without the impact of capital gain – when the value of a house increases over time and exceeds its purchase price – the overall average return created by a FTB was £5.60 of wealth for every £1 of initial outlay and £0.30 on average for every year of ownership.

North v South

Our analysis offered a second valuable finding in that the capital gains, on average, contributed to just 56% of the overall gross returns while the remaining 44% was attributed to other benefits from buying with a mortgage, such as building up equity and enjoying lower housing costs as the mortgage gradually reduced. This varied from place to place with the return in some regions relying more on the growth in house prices than others, as the ratio stood at 51% in the north-west as opposed to 60% in the south-west, for example.

The third major finding was that, despite the huge range in the level of average house prices between regions broadly from north to south, the financial benefits still hold for all areas.

It is worth noting that there are two other financial benefits from home ownership: passing it on as an inheritance, or using it as collateral for future leverage on low-cost loans.

Some non-financial benefits were also perceived as significant by some buyers but they were highly subjective and difficult to quantify. This could be things such as security and stability, a sense of belonging and putting down roots for a family. How important these benefits might be to individuals, should be equally considered when making a buy-or-rent decision.

The significance of the financial gains analysed in this study and the other non-quantifiable benefits would strongly suggest that “all roads lead to owner occupation” for those who can afford it. This applies even to those who wish to stay in their home for a limited number of years – a traditional argument against owner occupation which could be seen as an obstacle to the benefits of labour mobility (how easily people can move to new jobs).

On the other hand, the study does not address the dangers of over-indebtedness or negative equity – when house prices fall significantly shortly after purchase, leading to a mortgage debt that exceeds the market value of the house. This is often experienced in the short term during major downturns in the housing market. However, this is really only a serious problem when it coincides with loss of employment. In the UK these kind of circumstances only occurred recently in the recession at the end of the 1980s. There were no equivalent large-scale job losses after the global financial crisis of 2008.

Before our study there had been little research into the financial gains from buying versus renting. We demonstrated that, purely in financial terms, buying was a sounder choice than renting across the UK between 1975 and 2011, even in the face of recession. The deep-seated home-owner aspirations of Britons are justified and have been sustained by significant financial gains. It really does pay to buy.

Abdulkader Mostafa, Assistant Professor in Finance, Edinburgh Business School, Heriot-Watt University and Colin Jones, Professor of Real estate, Heriot-Watt University

This article is republished from The Conversation under a Creative Commons license. Read the original article.