Could Roth Options in Retirement Plans Offer a Practical Fix for US Deficit Pressure?

Explore a proposal to expand Roth options in US retirement plans, offering voluntary early tax payments to aid deficit reduction and financial strategy

Policymakers and investors face a complex dilemma: America’s national debt continues to climb while retirement accounts hold over $39 trillion in largely untaxed assets that won’t generate revenue until workers begin withdrawing them decades from now. The Congressional Budget Office recently issued an estimate that Trump’s tariff policies could reduce the federal deficit by $2.8 trillion if enacted and kept in place for ten years.

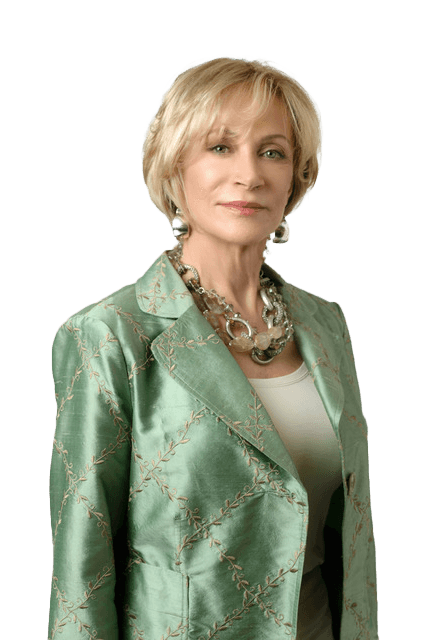

One financial adviser believes the solution lies not in changing tax policy but in expanding choices already available to savers. Nancy Hite, a Certified Financial Planner and author of The Retirement Mirage: Time to Think Differently, has written to members of Congress and to President Trump posing that all retirement plans be required to offer Roth options. Her reasoning centers on the voluntary nature of the approach: rather than forcing anyone to pay taxes earlier, it simply gives more Americans the choice to do so.

The Retirement Mirage: Time to Think Differently

Don’t be fooled by the retirement mirage.Are you still buying into the retirement mirage, hoping that, once you stop working, your life will be a perpetual enjoyment, exploration, and pleasant experience? It’s time to think differently. Your ideas about retirement are dissipating before your eyes. People are living longer, and the world is changing faster because of advancing technology. Twenty-first century notions about retirement are antiquated.

We don’t run ads or share your data. If you value independent content and real privacy, support us by sharing.

The Scale of Untapped Revenue

Hite’s proposal targets the massive pool of deferred tax obligations sitting in traditional retirement accounts. ‘Americans collectively hold over $39 trillion in retirement assets,’ she explains. ‘This includes IRAs, 401(k)s and both defined contribution and benefit plans—but excludes public pension reserves.’ Current market data supports the scale of these holdings, with 401(k) savings rates hitting record highs of 14.3% including employer contributions.

‘Let’s remember that the only person you can trust to take care of your older self is your younger self.’ – Nancy J. Hite

The financial adviser argues that even a modest voluntary shift toward Roth contributions could generate meaningful upfront tax revenue for the Treasury. Unlike traditional retirement accounts where taxes are deferred until withdrawal, Roth contributions require savers to pay income tax immediately on the money they contribute. The funds then grow tax-free, and retirees can withdraw them without owing any taxes.

Why Investors Might Choose to Pay Earlier

The proposal hinges on whether Americans would voluntarily choose to pay taxes now rather than later. Recent data suggests retirement savers are already embracing higher contribution rates despite market volatility. Americans maintained high retirement savings rates through recent market turbulence, with many missing out on the S&P 500’s best May performance in 35 years when they reduced contributions due to volatility concerns.

Several factors could make early tax payment attractive to savers. Younger workers in lower tax brackets might prefer paying taxes at their current rate rather than risk higher rates in retirement. Others might value the certainty of tax-free retirement income over the uncertainty of future tax policy. This consideration has become increasingly important as more pensioners face unexpected tax bills in retirement.

Fidelity reports that 537,000 participants ended 2024 with more than $1 million in 401(k) accounts, suggesting many savers have substantial assets that could benefit from tax diversification.

Managing Investor Choice

Hite emphasises the voluntary nature of her proposal. ‘This is not about changing the rules,’ she says. ‘It’s about expanding choice.’ Currently, not all employer-sponsored retirement plans offer Roth options, limiting workers’ ability to decide how they want to handle taxes on their retirement savings. Her proposal would ensure every plan provides both traditional and Roth alternatives.

The expansion aligns with modern investor preferences for flexibility and control over their financial futures. Rather than mandating early tax payments, the approach recognises that different workers face different tax situations and retirement goals. Some might benefit from traditional tax-deferred savings, while others could gain advantages from paying taxes upfront.

Dual Benefits for Treasury and Retirees

The proposal offers potential advantages for both government finances and individual retirement security. For the Treasury, voluntary Roth contributions would provide immediate revenue without requiring tax rate increases or complex legislative changes. The Congressional Budget Office recently highlighted how various policy approaches could impact deficit projections, with some measures reducing cumulative deficits by trillions over time.

‘The reason more people are not millionaires or multi-millionaires is not because they do not make enough money. In my opinion, there are three main reasons: It is because they spend too much of the money they make on depreciating assets. It is because they try to invest without a strategy for protection. And it is because they pay far too much in taxes.’ – Nancy J. Hite

For retirees, accessing Roth options could provide valuable tax diversification. Having both tax-deferred and tax-free retirement income sources allows retirees to manage their tax burden more effectively during withdrawal years. The approach also provides certainty—retirees know their Roth withdrawals won’t be subject to future tax policy changes or rate increases, a significant concern as fiscal drag continues to pull more retirees into higher tax brackets.

‘The result?’ Hite explains, ‘A dual benefit: greater predictability for government cash flow now, and more financial flexibility for retirees later.’ This positions the proposal as addressing both fiscal policy concerns and individual retirement planning needs without creating adversarial relationships between government revenue requirements and personal financial security.

Legislative and Regulatory Context

Implementing universal Roth options across all retirement plans would require coordination between various regulatory bodies and plan administrators. Current retirement plan regulations already accommodate Roth options in many contexts, but extending the requirement to all plans would need Congressional action.

The proposal comes as fiscal policy uncertainty impacts investment markets and politicians seek deficit reduction alternatives. Some policymakers favour approaches that generate revenue without appearing to raise taxes on working Americans, making voluntary early tax payments potentially appealing from a political perspective.

The regulatory framework would need to address plan administration costs, participant communication requirements and coordination with existing retirement account rules. However, many employers already offer Roth 401(k) options, suggesting the infrastructure exists to expand the approach more broadly.

What Happens Next

Hite has submitted her detailed proposal as a formal op-ed to several national

publications, aiming to generate broader policy debate around retirement account choices and deficit reduction. She notes that policymakers and editors can request copies of her full analysis, titled ‘How to Reduce the Deficit Without Raising Taxes.’

The timing aligns with ongoing debate about budget reconciliation procedures and deficit control measures. With governments worldwide considering tax policy changes to address budget shortfalls, proposals that generate revenue through expanded choice rather than mandatory tax increases could attract bipartisan interest.

Whether the proposal gains legislative traction will likely depend on broader discussions about tax policy, retirement security and deficit reduction priorities. The approach offers policymakers a way to address revenue needs while positioning the change as expanding opportunities for American savers rather than imposing new requirements on them.

About Nancy Hite

Nancy J. Hite is a certified financial planner (CFP®) and accredited investment fiduciary (AIF®) who founded The Strategic Wealth Advisor with a focus on helping clients navigate the reality that ‘there are only three things they can do with money: spend it now, spend it later, or spend it never’. With additional credentials including CWS®, ChFC® and CLU®, Hite specialises in working with business professionals, medical professionals and small to midsize business owners aged 45 and over who are concerned about maintaining their desired lifestyle in retirement while leaving a legacy for family and charity.

Hite is the author of The Retirement Mirage: Time to Think Differently, which challenges conventional retirement planning assumptions in an era of increased longevity. Known for her ‘Keep it Simple, Sweetie’ approach, she takes a commonsense view of financial planning, comparing the process to following a recipe step-by-step. Her client base typically includes individuals with investment portfolios who recognise that longer lifespans may require what she calls an ‘encore career’ rather than traditional retirement. More information about her practice is available at https://thestrategicwealthadvisor.com/ .