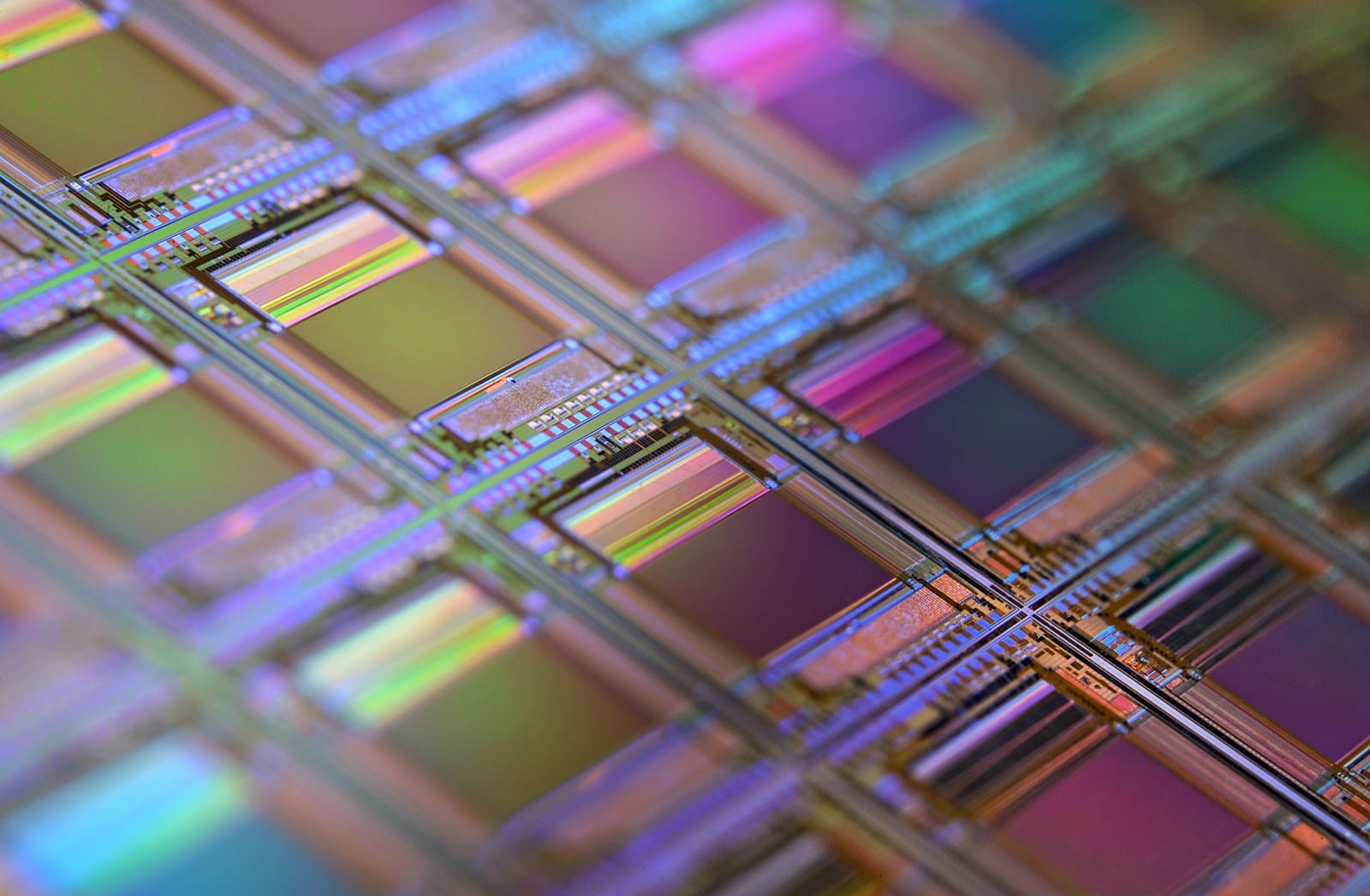

The semiconductor war between the United States and China has entered a new phase, with Washington targeting one of the most critical yet invisible components of chip manufacturing: the software that designs semiconductors themselves.

Recent government orders have forced American companies to halt shipments of electronic design automation (EDA) software to Chinese customers without proper licences. This move strikes at the heart of China’s chip industry, as these tools are essential for creating virtually every modern semiconductor.

The Software Behind Every Chip

No ads. No tracking.

We don’t run ads or share your data. If you value independent content and real privacy, support us by sharing.

Read More

EDA software might not grab headlines like manufacturing equipment or finished processors, but it sits at the beginning of every semiconductor’s journey. Companies like Cadence , Synopsys and Siemens EDA provide the digital tools that engineers use to design, simulate and verify chip circuits before they’re manufactured.

These aren’t simple drawing programmes. Modern EDA suites handle billions of transistors, predict how heat will flow through complex 3D structures, and simulate electromagnetic effects at frequencies measured in gigahertz. Without them, designing today’s advanced semiconductors would be essentially impossible.

The three companies control roughly 75% of the global EDA market, with Cadence and Synopsys each holding approximately 30% market share. For Chinese chip designers, this presents a significant vulnerability. According to Chinese state media, these American firms together control more than 70% of China’s domestic EDA market.

A Critical Choke Point

The timing of these restrictions reveals their strategic importance. EDA tools represent what trade experts call a ‘choke point’ – a narrow passage through which an entire industry must flow. Unlike manufacturing equipment, which China has been working to replace with domestic alternatives, advanced design software requires decades of development and massive research investment.

‘They are the true choke point,’ said a former Commerce Department official, explaining why EDA restrictions had been under consideration since the first Trump administration but were previously deemed too aggressive.

The market’s reaction underscored the significance of this move. Cadence shares fell 10.7% and Synopsys dropped 9.6% when news of the restrictions broke, before recovering somewhat in after-hours trading as companies clarified they had not yet received formal notices.

For Synopsys, which derives about 16% of its annual revenue from China, and Cadence, which gets roughly 12% of its income from Chinese customers, these restrictions could prove costly. But the broader implications extend far beyond these companies’ quarterly earnings.

China’s Response Strategy

Chinese authorities aren’t sitting idle. Domestic EDA companies like Empyrean Technology and Primarius Technologies saw their shares jump 17% and 20% respectively as investors anticipated increased demand for local alternatives. The Chinese government has long identified EDA software development as a strategic priority, listing it among key semiconductor breakthroughs needed in its 14th Five Year Plan.

Some industry observers question whether these restrictions will achieve their intended effect. ‘I believe this is another ineffective measure that will only help China advance its self-reliance, just like with semiconductors,’ said Nori Chiou, investment director at Singapore-based White Oak Capital Partners.

Chiou pointed to the availability of pirated versions of design tools and suggested that blocking legitimate channels could accelerate development of Chinese alternatives. Huawei, already facing Western concerns, has reportedly developed its own EDA tools for chips that can be produced at 14-nanometre or more advanced nodes.

The Broader Technology War

This latest move represents an escalation in the ongoing US-China technology competition , which has expanded beyond advanced semiconductors to include older ‘mature node’ chips and now the tools used to design them.

The December 2024 expansion of semiconductor export controls by the Biden administration already targeted various aspects of China’s chip industry, adding 120 Chinese entities to restricted trade lists. These new EDA restrictions appear to be part of this broader strategy, aimed at preventing China from developing indigenous semiconductor capabilities that could support military applications or artificial intelligence systems.

As China’s tech firms increasingly challenge US dominance with innovative approaches that require fewer resources, the competition has intensified. Beijing has responded with its own export controls on critical minerals like gallium and germanium, essential for semiconductor manufacturing.

Industry Impact and Future Outlook

For Chinese semiconductor companies, the immediate impact may be limited as existing licences continue to operate and companies work through current projects. However, the longer-term implications could be significant. Three sources in the EDA industry confirmed that business was continuing normally while companies awaited clarification on implementation.

The restrictions highlight a fundamental challenge in modern chip design: the concentration of critical capabilities in a handful of companies. As semiconductors become more complex and move to advanced manufacturing nodes like 3nm and 2nm, the software tools required to design them become correspondingly sophisticated.

This isn’t just about current chips. Next-generation technologies like artificial intelligence processors, autonomous vehicle systems and advanced telecommunications equipment all depend on the most cutting-edge design tools. Control over these tools effectively shapes which countries can participate in developing future technologies.

The episode also demonstrates how quickly geopolitical tensions can disrupt established business relationships. Companies that had operated in China for decades under relatively stable conditions now find themselves navigating export controls, licence requirements and the constant threat of expanded restrictions.

While Western firms invest heavily in manufacturing capacity to maintain their competitive edge, the technology competition between the US and China continues to intensify. Other critical software and hardware categories may face similar scrutiny, creating new risks but also potential opportunities as different regions seek to develop alternative supply chains.

The semiconductor industry, once characterised by extensive global cooperation, is increasingly fragmenting along geopolitical lines. Europe finds itself caught between competing tech powers, while EDA software restrictions represent another step in this fragmentation, with implications that will likely extend far beyond the immediate companies involved.